rsu tax rate california

RSUs can trigger capital gains tax but only if the. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k.

7 Things You Need To Know About Your Restricted Stock Units Rsus X And Y Advisors Inc

Theyre taxed as ordinary income - so its based on your marginal tax bracket.

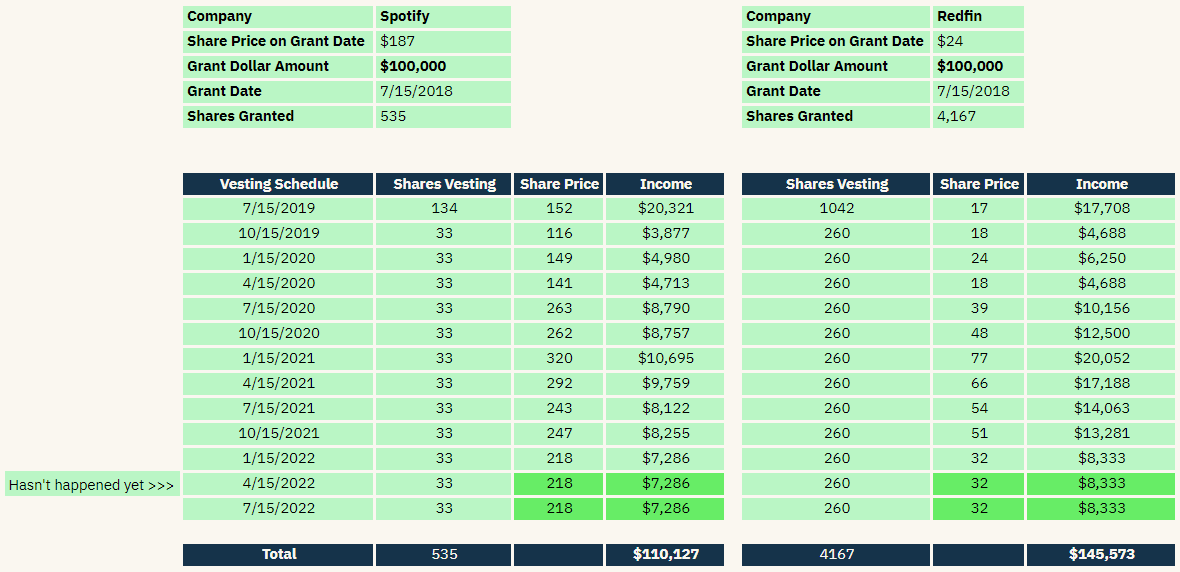

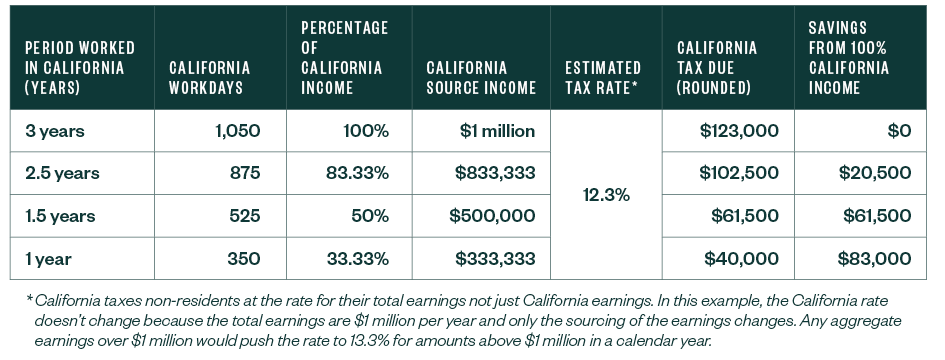

. California considers RSUs to be compensation for services performed and to the extent that those services were performed in California the income is taxable there. Close ss tax stops at 1287. Also restricted stock units are subject.

The capital gains tax rate when you sell the shares you own. Vesting after making over 137700. Since your regular paychecks are taxed based.

Long-term capital gains are taxed at a special lower rate. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. 2510276 43 withholding that you saw.

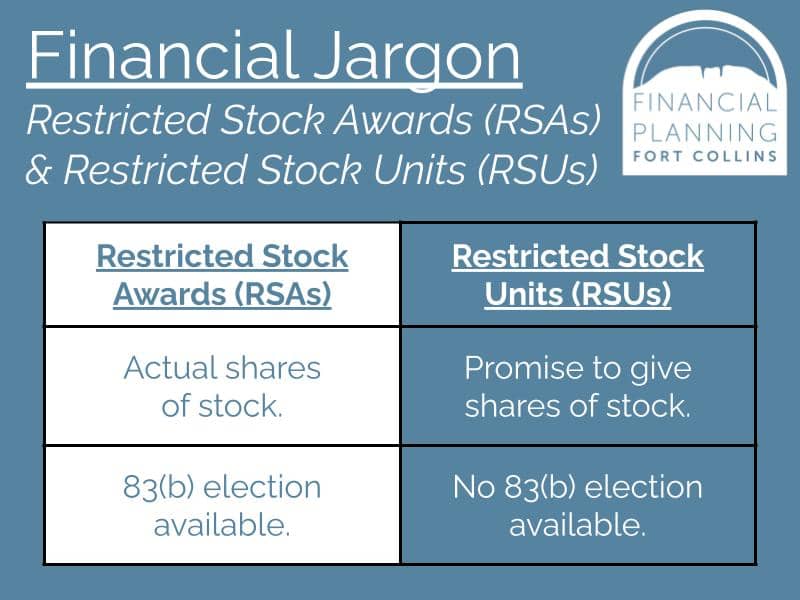

Vesting after making over. For most people the tax rate on long-term. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

With an all-in tax rate of 15 you only need to pay. California withholds 1023 as each RSU tranche vests. This doesnt include state income Social Security or Medicare tax.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate. RSUs are supplemental income - theyre withheld at a 25 federal rate and a 102 rate in CA.

The number of shares of stock. In order to make. May 1 2018 0.

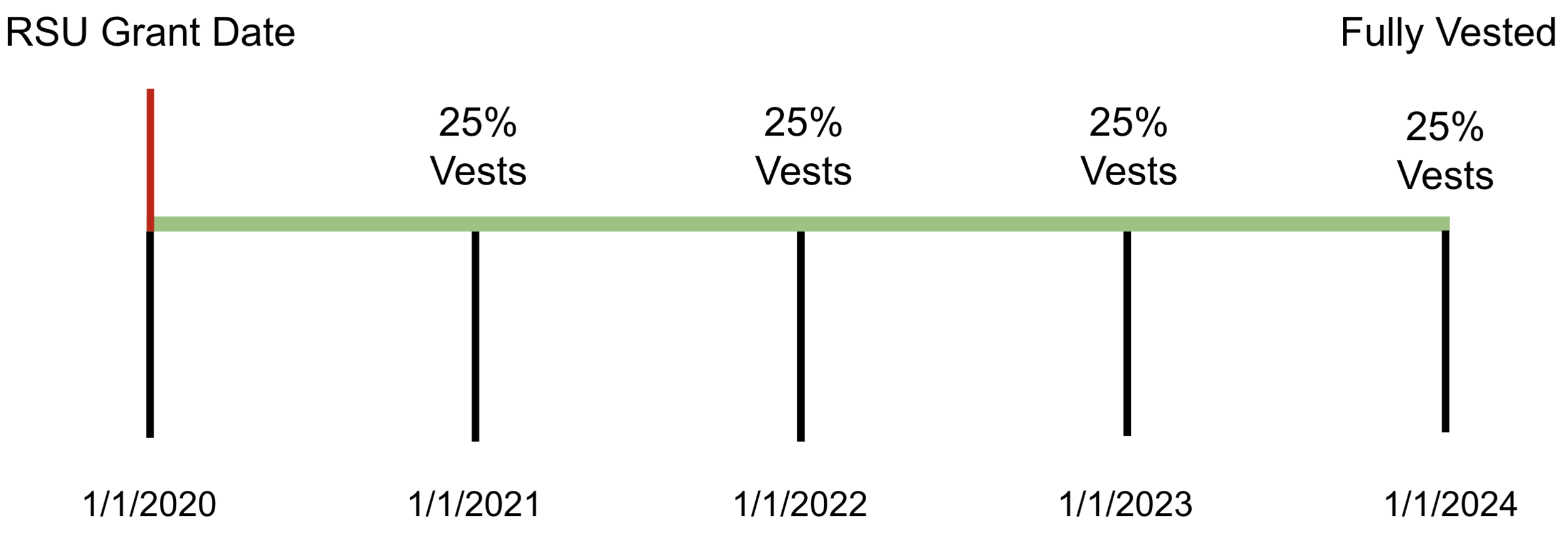

Its around 40 withheld. You are granted 10000 rsus shares of company stock that vest at a rate of 25 a year. Vesting after Social Security max.

RSU income bonuses and sales commissions are a type of income called supplemental wages which are subject to a series of. Carol Nachbaur April 29 2022. If you sell stock less than two years after the.

May 1 2018 0. The value of over 1 million will be taxed at 37. Vesting after Medicare Surtax max.

Since you performed 50 percent of your services in California from the grant date to the exercise date 50 percent of the wage income would be taxable by California. Most companies will withhold federal income taxes at a flat rate of 22. The earned income of the employee from the corporation granting the option for the taxable year in which that option is exercised does not exceed 40000.

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. 60 net would suggest the tax rate is around 40.

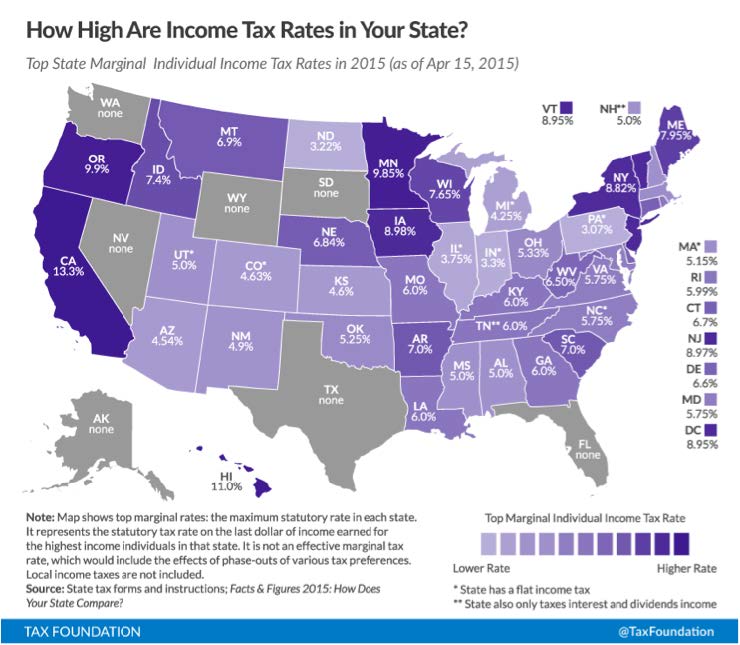

For those living in California with its top tax rate of 133 leaving California before selling ISO shares can be potentially lucrative.

Common Rsu Misconceptions Brooklyn Fi

How State Residency Affects Deferred Compensation

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Restricted Stock Units Rsus Facts

When Do I Owe Taxes On Rsus Equity Ftw

Rsus Vs Stock Options What S The Difference Carta

:max_bytes(150000):strip_icc()/Restricted-stock-unit-c46e678be3ea4ed19368bec0f1adb990.jpg)

Restricted Stock Unit Rsu How It Works And Pros And Cons

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

When Do I Owe Taxes On Rsus Equity Ftw

Taxation Of Restricted Stock Units Rsu And Stock Options

Can You Use Rsu Compensation For A Mortgage Better Mortgage

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

All About Rsus And Rsas Too Financial Planning Fort Collins

Reporting Sales Of Stock On Your Taxes H R Block

Changes In Irs Form 1040 Affect Tax Returns Involving Stock Options Rsus Espps The Mystockoptions Blog